Chinese Money Triggers a Dizzying Rally in Manila Property

May 7, 2018 at 09:57

Chinese Money Triggers a Dizzying Rally in Manila Property

Bloomberg News |

The Linear Makati development in the San Antonio Village area of Makati City. Photographer: Carlo Gabuco/Bloomberg

In Manila’s main financial district and its fringes, signs of the new inhabitants are everywhere: the restaurants serving steaming Chinese hotpots and dumplings, the Mandarin broadcasts at the Mall of Asia, and the soaring property prices.

An estimated 100,000 migrants, mostly Chinese, have flooded into pockets of the Philippines capital since September 2016, and the deluge is rippling through the city’s real estate market in ways that are unique among the world’s urban centers. While Chinese investors have been snapping up big swathes of high-end housing in Hong Kong, London and New York for years to move their money offshore, this new rush is motivated by something different: Manila’s booming gaming industry.

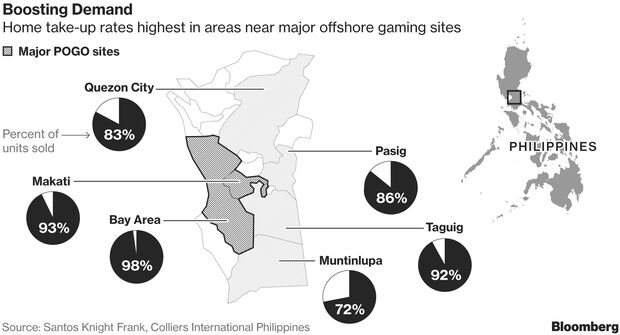

More than 50 offshore gambling companies that cater to overseas Chinese punters have received permits to operate in the city since President Rodrigo Duterte’s government began awarding licenses 19 months ago. While bets are placed remotely, the operators need Chinese speakers in Manila to handle everything from marketing and customer queries to payment processing for overseas clients.

While no official numbers are publicly available showing the number of Chinese arrivals in Manila, people familiar with the matter said that offshore gaming operators in the Philippines employ about 200,000 workers, predominantly Chinese, and more than half of them have arrived in the capital region since late 2016. The Bureau of Immigration said it couldn’t immediately provide the data.

The influx promises to boost the nation’s economy and is helping to strengthen ties with China — a priority for Duterte. Yet it leaves the property market vulnerable in the event of an abrupt shift in online gaming or immigration policies from either country.

The perils of relying too heavily on Chinese buyers became painfully obvious last year in the Malaysian enclave of Johor Bahru, which has been grappling with a glut of vacant homes after China imposed controls on investments in overseas property and demand abruptly dried up.

“Concentration risk could be a potential concern,” said Emilio Neri, an economist at the Bank of the Philippine Islands in Manila.

Partially completed buildings in the Iskandar Malaysia zone of Johor Bahru, Malaysia. Photographer: Ore Huiying/Bloomberg

Others see only opportunities. Qiang Huang, a realtor based in the Chinese city of Hefei, expects Manila home prices to get a boost from the steady stream of Chinese workers catering not only to offshore gaming customers, but also mainland clients who frequent brick-and-mortar casinos.

A high-rolling gamer himself, Huang first visited the area in November to place bets at Bloomberry Resorts Corp.’s Solaire casino and realized that Manila could scratch more than his gambling itch. He’s planning to build a 500-square-meter showroom in the city to lure Chinese real estate investors and will soon sign contracts to market apartments at two projects.

“I chose an area with a booming gambling business, as properties there have the largest potential to appreciate,” Huang said, adding that he has run into Chinese tourists who have formed “property-shopping” groups.

The Solaire Resort and Casino in Manila.Photographer: Taylor Weidman/Bloomberg

Among the biggest beneficiaries of this appetite have been condo units near Manila’s Makati district, in close proximity to the gaming sites where mainland workers are employed. Patches of San Antonio Village, about one kilometer from Makati’s financial hub, now have restaurants, stores, money changers and payment centers catering to Chinese customers sharing space with local stores.

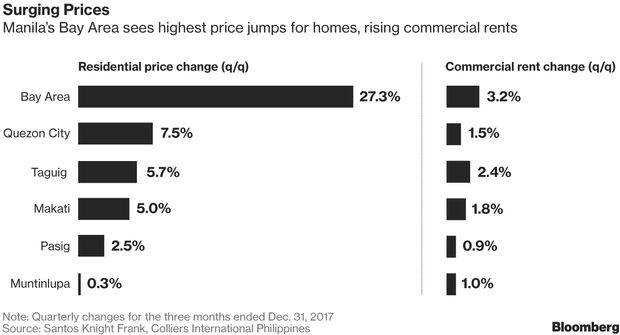

In the Bay Area adjacent to Makati, home prices surged by a record 27 percent in the last three months of 2017, according to data from Santos Knight Frank Inc., dwarfing the 6 percent overall gain in residential prices in the metropolitan Manila area. Condo sales in the capital region rose to an all-time high of 52,600 units in 2017.

A Chinese Beauty Salon in San Antonio Village.Photographer: Carlo Gabuco

Appetite from gaming operators is also supporting the commercial market as demand from traditional outsourcing companies wanes. The share of take-up of new office space by outsourcing companies decreased by a third to 46 percent in 2017, while that of offshore gaming operators tripled to 30 percent, said David Leechiu, CEO at Leechiu Property Consultants, which has partnered with CBRE Group Inc. in the Philippines.

“If not for offshore gaming operators, the property market would have crashed last year,” Leechiu said.

A typical online gaming operation consists of dealing studios and a call center-like facility that serves offshore customers. A studio that Bloomberg News recently toured in Makati City spanned roughly 400 square meters, with tables for games such as baccarat, Dragon Tiger and Fantan. Dealers — mostly young Filipino women wearing snug halter-neck dresses — staffed each table.

Eight kilometers away, in another part of the city, is the main customer-service center. The 6,000 square meter space is divided into dozens of rooms with rows of desks that seat more than 5,000 employees. A cafeteria serves free meals around the clock, catering to the army of mostly mainland workers and some Taiwanese and Malaysian staff. Other amenities include a hotpot restaurant and a convenience store stocking Chinese snacks and other products.

Fast Facts on Philippine Offshore Gaming Operators

- Also known as POGOs

- Such operations were limited to three provinces north of Manila before Sept. 2016 decision to expand them to the capital region

- 55 permits for POGOs have been awarded since then

- 14 of those are engaged in sports betting

- Revenue from POGOs quintupled to 3.57 billion Philippine pesos ($70 million) in 2017 from a year earlier

Source: Philippine Amusement & Gaming Corp.

Record Earnings

Chinese demand is helping stoke record earnings at some builders. At SM Prime, the nation’s largest property developer, Chinese buyers accounted for almost 30 percent of residential reservation sales in the first quarter. The share of mainland nationals who bought homes from Ayala Land jumped to almost half of all sales to foreign buyers last year from 30 percent in 2016. Offshore gaming companies occupy 60 percent of DoubleDragon Properties Corp.’s completed office space in the Bay Area and they’re paying rents one-third higher than other tenants, said Chief Executive Officer Injap Sia.

A condominium development under construction in Manila Bay.Photographer: Carlo Gabuco/Bloomberg

Developers aren’t betting that boom times will last forever. Ayala Land’s President Bobby Dy said the builder will limit offshore gaming leases to 10 percent of its office portfolio. DoubleDragon plans to cap total exposure to such tenants to 30 percent once all its office towers are completed. The firm requires a one-year deposit from offshore gaming operators and post-dated checks for the duration of the five-year contract.

Kitt Lapeña, 34, a Makati resident for most of his life, has seen waves of foreign residents come and go before, from Japan and Korea, but never on the scale of the recent Chinese influx. While he welcomes the economic boost, he worries about the motivations of the new arrivals.

“In a way, it’s good for business,” Lapeña said. “I hope they become an asset to the community and not just out to make money.”

— With assistance by Siegfrid Alegado, Clarissa Batino, Lilian Karunungan, Emma Dong, Ian C Sayson, Cecilia Yap, Hannah Dormido, and Adrian Leung