Executive Summary

Arangkada Philippines 2010: A Business Perspective is about creating a bright future for the Philippines, the 12th most populous country and probably the 10th or 9th by 2030. Arangkada is a guidebook to a better Philippines, with the Per Capita Income (PCI) of a middle-income economy, robust investment levels, better infrastructure and higher government revenues to pay for social services, especially education and health. Absolute poverty would be reduced by inclusive growth with less malnutrition, crime, and insurgency. With more rewarding opportunities at home, Filipinos would have less reason to work abroad.

Richly illustrated with numerous graphics including 350 figures, tables and maps, Arangkada Philippines 2010 contains 471 recommendations from Filipino and foreign businessmen and women for building a more competitive economy, reform-by-reform, leading to high growth and millions of new jobs. Catching up and keeping up is an imperative, not a choice. The Philippines has lagged for too long, losing competitiveness, despite its immense potential and location in the fastest growing region with 60% of the global population. More than ever, opportunities abound for the Philippines to improve trade and investment ties in Asia and elsewhere and advance towards high-income status.

Despite a dynamic population and a land blessed with natural resources, economic progress has been slow. In most international ranking surveys, the Philippines is slipping. The country has not improved its competitiveness as much as others and continues to slide despite recent GDP growth and rising PCI. The country should strive to move twice as fast –”Arangkada” – which means “to accelerate.”

Part 1. Growing Too Slow: Faster Growth is Essential

The biggest challenge facing the Philippines is to move the economy to a higher level of growth and job creation. PCI barely grew during the 1980s and 1990s, with boom-bust cycles triggered by political events and high population growth. Of the ASEAN-6, for the past five decades, the Philippines had the lowest GDP and PCI growth. But since 1999 through mid-2010, real GDP growth averaged 4.6%, raising PCI from US$1,019 to US$1,748 over a decade. Only recently, with rising remittances and slowing population growth, does Philippine GDP growth again come close to the ASEAN-6, except for Vietnam.

Philippine growth has not been inclusive. In 2006 there were 24 million poor Filipinos, about the same percentage of population as in 1986. By contrast, the other ASEAN-6 eliminated poverty or reduced it by half. In the fast-growing Asian region, the Philippine economy is becoming relatively smaller, in share of total GDP and in PCI, among the ASEAN-6. In 1960 Philippine PCI was second to Japan. In 2009 Indonesian PCI passed the Philippines, as Vietnam is projected to do in 2014, which will give the Philippines the lowest PCI of the ASEAN-6.

Although located in the world’s fastest growing region (rising 8.9% in 2010), the Philippine economy has long grown slowly. China, Hong Kong, Indonesia, Japan, Korea, Malaysia, Singapore, Taiwan, and Thailand have grown an average of 7% for over 25 years. India and Vietnam may eventually join this group. The Philippines must have an 11.6% growth rate to reach a PCI of US$12,0001 by 2030, assuming a 2% population growth rate declining to 1.5%.

With a labor force of 38 million, up 50% since 1990 and projected to reach 54 million by 2030, creating new jobs and giving students and workers needed skills are major challenges. Combined unemployment and underemployment rates exceed 25%; 43% of the workforce is in the informal sector. The NCC has called for an industrial policy to create 15 million “quality” jobs, reducing unemployment to the regional average and ending underemployment.

Remittances of Filipinos abroad increased 187% in 9 years to approach US$ 20 billion and will soon be the country’s largest source of foreign capital. They stimulate an increasing share of GDP growth and shield the elite from pressure to reform. Global demographic trends favor the country, with its large and growing labor pool for overseas and domestic employment. Foreign labor markets in countries with aging populations and labor shortages remain open.

Investment is needed for higher growth, yet the investment rate has fallen from 25% in 1997 to 15% in 2009. FDI is weak, and government has inadequate revenue for capital spending. Doubling spending on physical infrastructure (to 5-6% of GDP) and social infrastructure (to 8-9% of GDP) would greatly improve the investment climate and support higher, sustainable rates of growth.

Philippine FDI inflows are the weakest of the ASEAN-6. Political instability deterred foreign investment in 1970-89, when net FDI averaged US$ 200 million. Net FDI rose to a US$ 1.4 billion average in 1990-2009, reaching US$ 3 billion in 2006 and 2007. From 1970-2009 the country received US$ 32 billion in FDI, but Indonesia, Malaysia, and Thailand each received 2-3 times as much. Over the last decade, the Philippines received only 4.5% of total FDI of the ASEAN-6. Many multinational firms not already present in the Philippines bypassed the country.

Philippine commodity exports reached a record high of US$ 50.5 billion in 2007, contributing 35% of GDP but face many challenges. The top exports are electronics (60%) and other manufactured goods (25%). Agro-based products (6%) and mineral products (4%) are underdeveloped. IT-BPO service exports – valued at US$ 8 billion in 2010 – could more than double to US$ 20 billion by 2015.

RECOMMENDATIONS (8):

Adopt a plan to double GDP growth in 3 years and target US$ 7.5 billion in annual FDI and US$ 100 billion in exports. Prioritize job creation. Fund a branding/marketing campaign. Channel remittances into investment. Double public sector investment in physical and social infrastructure. Organize a Special Experts Group to recommend key reforms.

Part 2. The Philippine International Competitiveness Landscape

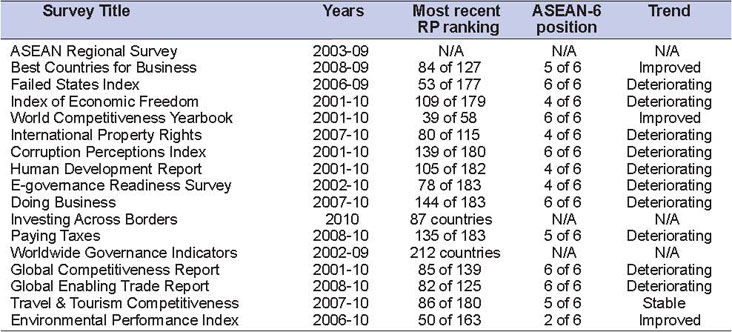

While Filipinos are competitive in the world job market, the country’s competitiveness has declined. Global rating surveys abound, with ever-expanding coverage, stimulated by the globalization of investment, trade, and information. Arangkada Philippines 2010 summarizes 17 ratings appearing in recent years, including those by the IMD, UNDP, TI, WEF, and World Bank/IFC.

Data in Part 2 frequently compares the Philippines to the ASEAN-6 economies in percentile terms, which show the country relative to these economies in a consistent fashion and also measure trends. Specific relevant details of survey rankings are included in Parts 3 and 4. Data series go back to 2001 where possible. Resultant graphs can be an excellent planning guide for remedial projects to improve competitiveness.

Global competitiveness surveys in Part 2, ranking of Philippines

The Philippines is being left behind by most neighbors in too many measures of competitiveness. Indonesia and Vietnam, ranked lower in the past, are overtaking the country. The Philippines is on a downward trajectory in international competitiveness rankings during the current decade, especially for corruption, governance, and infrastructure. Focused efforts to reverse the trend underway for several years are not yet effective. Efforts to reverse the trend must be sustained and intensified to produce more positive results sooner. Arangkada Philippines 2010 lists many recommendations to improve the competitiveness landscape of the Philippines.

RECOMMENDATIONS (3):

Undertake aggressive efforts to improve rankings faster. Improve low and medium ranked areas most important to investors. Create a national psychology to improve country competitiveness. Government actions should take into account their impact on competitiveness. Join hands with the private sector to fight corruption; join the Integrity Initiative driven by the Makati Business Club and the JFC.

Part 3. Seven Big Winner Sectors

A proven strategy to achieve higher investment and increase exports and jobs is to prioritize economic sectors with high growth potential. In 2009, the JFC released a study recommending the Philippines build up Seven Big Winner Sectors where the country has competitive advantages and high growth and employment potential. With its position within ASEAN, its large, youthful English-speaking population, and improved access through FTAs to fast-growing markets, the Philippines is situated to attract large FDI inflows that can create millions of new high-quality jobs in: (1) Agribusiness, (2) Information Technology-Business Process Outsourcing, (3) Creative Industries, (4) Infrastructure, (5) Manufacturing and Logistics, (6) Mining, and (7) Tourism, Medical Travel, and Retirement.

Nine Focus Group Discussions were held with the participation of Philippine and foreign investors to recommend next steps to accelerate growth of each Big Winner Sector. The results of these discussions are reported in Part 3. Each of its seven sections contains a narrative description with extensive data and graphics discussing background, potential, key issues, and recommendations. Part 3 contains 282 recommendations. Each has a suggested implementation period (immediate, medium-term, and long-term) and identifies public sector action agencies, as well as the private sector.

Agribusiness

Although 35% of the labor force is in agriculture, Philippine food exports are only 5% of the ASEAN-6 total. The Philippines has high potential to export large quantities of specialized food products exploiting a multitude of new market opportunities from FTAs. Filipino farmers face high domestic transport, labor, and other costs, and the Philippines lags in integrating small farms into larger enterprises. Mindanao has great potential, both to feed Luzon and to export. Long-standing farm infrastructure requirements need investment. CARP has discouraged corporate farming.

RECOMMENDATIONS (18):

Use new FTAs to increase RP agricultural exports. Lower cost of farm inputs. Ramp up agricultural R&D, education, and training. Update old and develop new agribusiness models. Large corporate integrators should link small farmers to large markets. CARP and limits of landholding should end in 2014. Pass Farm Land as Collateral Act, and make the mandated lending policy in the Agri-Agra law optional.

Information Technology-Business Process Outsourcing

[This] is the biggest of the Big Winners, because of its large size, high growth rate, and potential to provide millions of quality jobs and earn high service export revenue. The Philippines has clear advantages: a large workforce of educated, English-speaking talent with a strong customer-service orientation and cultural affinity to North America; highly reliable low-cost international telecommunications; diverse and inexpensive site locations; and strong government support. These drivers for success must be strengthened, while new reforms are also needed to realize the high growth potential. A better industry legal framework requires retaining fiscal incentives, passing three non-fiscal laws (Cyber Crime, DICT, and Data Privacy), fixing labor legislation that makes it more difficult to compete in the global market, and reducing the high number of holidays, which cost industry millions of dollars of unbudgeted expenses for every new holiday declared. The Labor Code should be amended to remove the prohibition against female employees working at night, to allow subcontracting, and to make it easier to terminate employees.

RECOMMENDATIONS (30):

Create a robust legal framework by passing DICT, Cybercrime, Data Privacy, Holiday Rationalization, and Labor Code amendments. Develop a highly positive, supportive environment for the industry. Adopt National Competency Test. Expand higher-speed broadband to more cities. Maintain fiscal incentive regime. Ensure LGUs are supportive. Promote industry with aggressive international marketing. Raise quality and quantity of labor supply. Implement educational reform to improve quality of graduates. Use English more in broadcast media and advertising, Internet cafes for English training, and place computers in public schools with English training software. Colleges should adopt curriculum for IT-BPO careers.

Creative Industries are very diverse, including advertising, animation, architecture, broadcast arts, crafts, culinary arts, cultural/heritage activities, design, film, literature, music, new media, performing arts, content development, mobile TV, publishing, and visual arts. Filipinos enjoy a well-deserved reputation for creativity. However, to better understand the sector, Philippine Creative Industries should be mapped and developed. There are legal issues that work against full development, such as limiting the practice of foreign professionals, the ban on any foreign equity in media, and the limit of 25% in advertising.

RECOMMENDATIONS (16):

Create a Philippine Creative Industries Master Plan, Creative Industries Development Council, and organize the private sector in a Creative Industries Initiative. Stimulate the creative industries environment with HR development, rebrand the Philippine creative image, protect IP, organize awards, exhibits, and lectures, study foreign markets, reduce local costs, develop uniquely Filipino products, encourage tie-ups with foreign firms, establish incubators for creative entrepreneurs and link them to business ‘angels,’ and encourage Filipino talent to stay home and return home. Encourage foreigners to practice creative industry professions in the Philippines, resulting in technology transfer, investment, and job creation. Remove restrictions on foreign equity.

Infrastructure Policy Environment

The Philippines significantly underinvests in physical infrastructure, with spending averaging 2% of GDP for the last 30 years, far below regional norms. Poor infrastructure is a key inhibitor to higher investment. In the Global Competitiveness Report, among the ASEAN-6, the country’s overall infrastructure quality ranks below Singapore, Malaysia, and Thailand and close to Indonesia and Vietnam. Arangkada contains lists of major projects completed (2001-10), under construction or being financed in 2010, and future projects (2011-20). Recommendations concern overall infrastructure policy and are followed by specific sub-sections for Airport, Power, Roads and Rail, Seaports, Telecommunications, and Water.

RECOMMENDATIONS (25):

Double spending on infrastructure to 5% of GDP by bidding out a pipeline of PPP projects to local and international developers, investors, and banks. Legal and procedural reforms are needed to revitalize PPP programs. Assure that the NEDA-ICC reviews all major projects; rescind JVA guidelines. Discourage unsolicited project proposals. Speed up project approval process. Focus congressional pork barrel on needed infrastructure. Create and follow a 10-year infrastructure master plan. Implement the National Transport Plan. Increase transparency and reduce corruption and controversy over infrastructure projects. Protect investors from political risks (TROs, LGU interference, right of way problems). Develop on-line registry to track major projects.

Airports

With its archipelagic character, the Philippines depends on air and sea transport more than continental countries. Filipinos are flying more than ever, since affordable airfares have stimulated domestic tourism. New terminals and modern equipment are needed, as are more direct international flights to secondary cities. The absence of a modern international gateway airport restricts tourism, trade, and investment. Clark and Subic have great potential for passenger and cargo operations.

RECOMMENDATIONS (15):

Prioritize investments in airport terminal, runway, and communication facilities. A Transportation Master Plan for Central Luzon until 2050 is needed. DMIA should be the primary international gateway, NAIA primarily a domestic airport, with a high-speed rail between NAIA, Makati, and DMIA. Settle the NAIA IPT-3 investor case with priority. Each region should have one international airport only. Rectify FAA and EU aviation downgrades. Prioritize international tourism; increase international carrier service through reduced costs and pocket open skies. Replace CIQ with 24/7 public service; end unwarranted taxes on foreign carriers.

Power

The Philippines is completing a long transition from a public sector power generation monopoly to a private sector-led “open access” competitive environment with enhanced regulatory oversight. Electricity prices are among the highest in Asia, and there are supply shortages in all three grids. Unreliable, expensive electric power is a major deterrent to foreign investment. Under the “open access” policy, rates will go up in the short-run, then down after more efficient generating plants are commissioned that are profitable at lower costs. Five conditions precedent to open access should be met by early 2011. Underinvestment in power will continue unless there is a clear energy policy indicating where the country will source future energy requirements and what will be provided as guarantees or credit enhancements. Renewable energy and nuclear technology offer excellent prospects for diversifying power sources. It is essential that the transmission and distribution expands in line with generation and growth in demand.

RECOMMENDATIONS (21):

The DOE should formulate programs such as credit enhancements, guarantees, and incentives to reduce merchant plant risk, which most lenders do not accept in financing new powerplants. Because investment in new cost-effective power generation projects requires initiation of “open access” and retail competition, conditions precedent to declaration of Retail Competition and Open Access should be fulfilled in early 2011. The remaining condition, the transfer of management and control of 70% of IPP contracts from NPC to IPPAs, is almost met. Because investments in new generation projects require a viable WESM, initiate Visayas WESM without further delay, integrate it with Luzon WESM, and initiate Mindanao WESM no later than mid-2011. Formulate an integrated energy policy plan including all energy sources (including nuclear power), plant locations, investment/financing, and energy efficiency. Enhance the creditworthiness of distribution utilities and cooperatives. Revisit take-or-pay for baseload plants. Remove restrictions on foreign equity in power projects. Introduce LNG for cleaner power and transportation. Privatize Agus and Pulangi dams. Energy efficiency and energy conservation have to be declared as national policy and legislation is needed to provide incentives and penalties.

Roads and Rail

Modern, efficient ground transportation infrastructure facilitates the efficient movement of goods and people, while their absence increases transport cost and ultimately harms country competitiveness. Unfortunately, the race is being lost to improve public transport before traffic gridlock worsens. While DPWH greatly increased its budget in recent years, too much spending has gone into barangay roads, built for political purposes, while the national road network has barely increased in two decades, (although traffic on national roads has multiplied). There are seven limited-access toll roads operating or under construction, all in Central Luzon, totaling under 300 kilometers. Another 300 kilometers are planned by 2020, which is too little, too slow.

The Philippines ranks a distant last among the ASEAN-6 for quality of railroad infrastructure. Intercity rail, nearly abandoned, is making a slow return. The DOTC has sought unsuccessfully for two decades to restore rail service north of Manila, despite foreign assistance. Three light rail lines are located in Metro Manila. New lines, while planned, inexcusably take many years to implement. One vital new line is undergoing financing. As with roads, this is too little, too slow.

RECOMMENDATIONS (9):

Build expressways and national roads twice as fast, using PPPs and DPWH funds. Build intercity rail and urban light rail, especially on Luzon, twice as fast, using PPPs and ODA (see lists pp 149-50). The national government budget should focus on the core road network. Major road and rail projects which government decides to fund as PPPs should be bid out competitively and evaluated and awarded transparently; unsolicited proposals should be minimized. Apply HDM-4 for roads. Create a single light rail agency for Metro Manila.

Seaports

Because the archipelagic Philippines depends on seaports to move most of its domestic and international commerce, efficiency of marine transport is critical to national competitiveness. Its high cost has long been a problem. Tourism growth is also influenced by seaport quality. Improving maritime safety is important given the high loss of life from the negligence of owners and government agencies. The volume of international container shipments is small compared to Asia’s export economies and lowest of the ASEAN-6. The quality of port infrastructure rank is also lowest among the ASEAN-6. Manila is ranked 90th worldwide in tonnage volume and 36th in container traffic. Over the last decade, there have been significant investments in international ports of Batangas, Davao, PHIVIDEC, and Subic, almost doubling their combined capacity. Yet Manila is highly congested and Batangas and Subic underutilized. The RORO Nautical Highway, with three routes connecting Luzon-Visayas-Mindanao, can be expanded and made more efficient. Regional ports need modernization with feeder links.

RECOMMENDATIONS (20):

A NCR/Central Luzon Transportation Master Plan up to mid-century is needed that fully utilizes Batangas, Manila, and Subic seaports, with modern ground transportation links to industrial and urban centers. Manila should be decongested gradually, shifting international container traffic to Batangas and Subic. Develop cruise business at Manila and other major ports. All major ports should have complete infrastructure using a hub-and-spoke system feeding goods by truck and RORO. Major RORO ports should have modern terminals. Allow chassis RORO. Reduce fees related to shipping; increase consortium arrangements with foreign lines. PPA should focus on being an independent regulator and promoting competitive private participation in port operations. Activate the National Port Advisory Council. Pass the new Maritime Law. MARINA should follow international shipping standards.

Telecommunications

[Reform in this area]] has been considerable. In a decade, Philippine telecommunications advanced from being monopolistic, high-cost, and inefficient to having considerable competition, enabling a majority of the population and businesses to communicate at home and abroad at much reduced cost. While fixed line penetration is lowest of the ASEAN-6, mobile phone penetration is high (80%), and digital fiber connections are robust. The next new technology for the country is high-speed wireless broadband. Within a few years many millions could have cheap Internet access on 3G cellphones. The benefit for national competitiveness of these changes could be enormous. Filipinos will be able to avail of global SMS, email, and Internet on mobile devices and “leap over” the low 21% household computer penetration level. In the UN E-governance readiness survey, the Philippine ranking has been declining.

RECOMMENDATIONS (11):

Undertake programs to use broadband to empower Filipinos, providing inexpensive access to information and e-governance. Develop a national plan to double computer and triple Internet penetration, including a National Broadband Roadmap and free Wi-Fi access in crowded urban areas. Prepare for widespread use of mobile phones and devices to connect Filipinos inexpensively to the Internet. Provide fiscal or other incentives and pass necessary legislation, including the DICT bill and Telecommunications Policy Act amendments. Make e-governance a reality for most Filipinos, enabling Internet access for interactions with government and enhancing transparency. A presidential Task Force should prepare recommendations for an ambitious e-governance program. Use digital fund transfer technology for public sector payments. Create a national government data center and website. Promote national GPS mapping and information systems. Expand mobile phone service in remote areas.

Water

Dependable supply and distribution of water for cities and agriculture is critical to growth and everyday life. The Philippines is challenged to store and deliver sufficient water and dispose of wastewater without damage to environment and public health. Prospective investors note the lack of an economic regulator and the inadequate capacity of the resource regulator. There is immediate need for the proposed Water Reform Act to create an institutional and legal framework to guide private and public cooperation in developing water sources. The present framework of some 30 agencies with varying jurisdictions must be rationalized, as it discourages new entrants. The supply situation in Metro Manila and 8 other urban centers has been described as critical. Immediate solutions to cope with anticipated water deficits should be identified and implemented. Angat Dam currently supplies 97% of Metro Manila’s water supply and water for irrigation and power. Additional dams are needed very soon, either Laiban or smaller ones, but the obstacle is financing. The ideal option is to bid out such projects, but the government lacks expertise to do this. Despite being the biggest consumer of water, the agriculture sector does not pay irrigation fees. Public sector irrigation systems are poorly maintained and inadequate. Flooding is common in low-lying areas of the archipelago, and is worsening with uncontrolled urbanization and climate change.

RECOMMENDATIONS (9):

To support financing of new water supply projects, the GRP should enhance creditworthiness of water supply agencies with performance undertakings. Alternatively, concessionaires voluntarily can enter into take-or-pay contracts for bulk water supply projects supported by their balance sheets or fund major new water supply projects directly. Rationalize water supply administration and policy via a Water Reform Act; strengthen the NWRB. Establish a Department of Water and an independent water regulator. Develop a National Water Master Plan that identifies major water resources and treatment requirements with supportive policies and IRRs. Engage private sector to build new dams for the NCR through transparent bidding. Policy disallowing “take-or-pay” and sovereign guarantees needs to be reviewed. Smaller, less expensive Sierra Madre or Wawa projects should be moved ahead while larger Laiban project is decided. Encourage private sector to invest in irrigation using the BOT law or joint venture with NIA. Reduce flooding by implementing measures to reduce sediments and disposal of garbage in waterways. Prohibit development within the flood plain.

Manufacturing

Asia’s developed economies had strong growth of their industrial sectors and large shifts of agriculture and services workers into manufacturing and exports. This has yet to take place in the Philippines, which has benefited less than Malaysia, Singapore, Thailand, and Vietnam from the globalization of trade and manufacturing. Unlike these four economies, which are strong exporters, the Philippine has not increased its export percentage of GDP for 30 years. Some 2/3 of total exports are electronics, involving about 1,000 firms and 400,000 employees. Without electronics, exports of manufactured goods would have grown very slowly, as garments exports have contracted. Another industry subsector declining in recent years is automotive manufacturing, undermined by used car imports. The high percentage of exports made up of electronics is a failure to develop a diversified mix of manufactured exports, creating a risk should the viability of electronics manufacturing decline. Domestic manufacturing in the country has never faced more challenges to its survival than today, such as high business costs, low import duties, and extensive technical smuggling. As long as smuggling provides better profits than manufacturing, the economy will be one of traders and smugglers rather than manufacturers. There appears to be no strong, unifying policy that manufacturing is a key component of economic and technological development. There is no industrial master plan, and funding for trade and investment promotion is small.

RECOMMENDATIONS (17):

Increase priority of manufacturing. Working with private industry, government should: develop an industrial master plan, identifying best sectors for export of goods and services to new and old global markets; support plan with consistent policies, fiscal incentives, legal, administrative, and other reforms; and keep a strong economic team in the cabinet working closely with private sector leaders of targeted global industries. Improve the business climate and level the playing field by reducing business costs (see Part 4); increase E2M coverage for customs; allow industry to operate with minimal government interference, such as price controls; and reduce smuggling by sending smugglers to jail. Ramp up promotion of Philippine exports and investment: establish an export development fund to promote exports and investment; aggressively promote the Philippines at trade fairs. Allow duty and tax-free importation of capital equipment.

Logistics

Batangas and Subic have new port infrastructure that can lower international shipping costs for CALABARZON and develop an Asian regional freeport at Subic. Batangas needs connections with feeder ports of Singapore, Kaohsiung, and Hong Kong. The country is well located for storage/distribution of goods to Asia, North America, and to Europe through the Middle East. The Subic-Clark-Tarlac Corridor, if Subic were a true freeport, could create a regional distribution hub with cost advantages over the Asian freeports (Singapore and Hong Kong). Container export cargo should begin to transfer to Batangas and Subic to reduce traffic congestion in Manila. A GRP decision is needed to close the Manila port to international cargo over 5 years. Turning Subic into a real freeport means allowing traded goods to enter and leave uncontrolled, except for controlled egress into Philippine customs territory. Using available air capacity of ME carriers, the Philippines is well located to act as a sea-air, or air-air transshipment hub to the ME. Logistics chain costs must be reduced to be more competitive, e.g. remove CIQ overtime charges. Open more logistics operations to international investors. Allow cargo deconsolidation to PEZA bonded warehouses. Product transformation in Philippines would enable tax/duty free distribution in ASEAN. Facilitate IOR services for Internet sales fullfillment. It is about 40% cheaper to transship a container from Manila to Cagayan de Oro via Hong Kong or Kaohsiung than shipping directly from Manila. Foreign companies are not allowed to provide maritime transport services. Domestic shipping industry is not competitive due to predominant use of small ships.

RECOMMENDATIONS (25):

Promote Batangas Port for CALABARZON-destined shipments and Subic for Luzon-destined shipments by inviting feeder vessel operators to call, linking them through Singapore, Kaohsiung, and Hong Kong to worldwide shipping. Develop Subic as a true freeport for logistics in Asia for goods from the US and Europe. Decongest Manila port by gradually transferring international container cargo to Batangas and Subic. Reduce logistics chain costs. Allow direct deconsolidation of cargoes to PEZA bonded warehouses instead of using non-PEZA CY/CFS operators. Develop a transshipment industry similar to Dubai and Singapore. Allow transshipment of cargo in various modes, air-air, sea-air, and air-sea by asking the BOC to implement relevant transshipment rules. Facilitate IOR services. Continue recent reforms in customs practices (Kyoto Protocol, E2M, and national single window). Open the door to foreign investment and foreign shipping services along the entire multi-modal transportation chain. Take advantage of quick turnaround cycles and local BPO capability.

Mining

With an estimated US$ 1.4 trillion in reserves, Philippine mining potential ranks 5th in the world, covering an estimated 9 million hectares, but less than 2% has mining permits. After long stagnation, the sector is coming back following a 2005 SC decision affirming RA 7942, considered a world-class legal framework for sustainable development. Minerals development is a top government priority and has great potential for jobs and revenue. Government has identified over 60 priority PPP projects. Mining can support poor rural areas through high quality jobs, local tax payments, and community development. The national government receives substantial royalty and tax payments. Government revenue from mining increased 800% from 2002 to PhP 10.4 billion in 2007. However, full development of the sector continues to face significant challenges. Lengthy, tedious approvals for EPs continue to impede investment. Several LGUs have closed their provinces to mining. Industry is concerned that the Writ of Kalikasan might disturb lawful activities. An investor cannot tell easily if land is ancestral land. Skilled MGB personnel often leave public service.

RECOMMENDATIONS (33):

Remove redundant approvals and non-performing claims. MGB should cancel permits after 2 years of non-performance. Grant exploration and similar permits transparently at regional level within 6 weeks. Renew them in a day at one-stop shops. Reduce ECC processing time. Allow pre-permitting access to potential project lands. MGB should adopt Philippine Mineral Ore Resources Reserve Reporting Code. Develop model best-practice regions. Work closely with indigenous peoples. Involve IPs as partners from project commencement. Achieve a 50% increase in direct mining and milling costs allocated for community development. Implement faster release to LGUs of their share of mining taxes paid to the GRP. Improve salaries and practical skills of MGB staff. Develop mining engineering programs at universities. Implement current Mining Act and avoid arbitrary application of the Writ of Kalikasan. Continue Minerals Development Council. Carry out a public information campaign and increase dialogue with concerned groups. Inform public about responsible mining that minimizes environmental impact. Find common-ground solutions with LGUs, NGOs, religious leaders, and local communities to issues raised against specific projects. National government should persuade LGUs not to have mining bans that conflict with national policy. Encourage downstream processing and manufacturing. Source supplies from local communities. Endorse the Extractive Industries Transparency Initiative.

Tourism, Medical Travel, and Retirement

Tourism can have strong poverty reduction and job creation effects. For every foreign tourist that spends US$ 1,000, one job for one year is supported. The range of direct and indirect income effects of tourism is enormous, involving agriculture, industry, and services. Travel and tourism is currently the 4th largest source of foreign exchange revenues. International arrivals exceeded 3 million in 2009, up by over 67% since 2001. Of 60 million international tourists recorded in SEA in 2009, only about 5% visited the Philippines. Domestic travel, the backbone of Philippine tourism, is resilient during times of external vulnerabilities, and doubled in 4 years to 14 million in 2009. Medical travel and retirement by foreign nationals are subsectors where the Philippines has high potential for competitive success. These are high yield markets since visitors stay longer and spend more. The government has offered a foreign retiree program for several decades, and in recent years the number of new participants has increased to 2,000-3,000 a year. The low cost of living, excellent weather, world-class medical care, recreational options, and warmth of Filipinos are plus factors supporting the high potential of the retirement subsector. The key to unlocking the job creation potential of tourism is investment mobilization, by both the public and private sectors.

RECOMMENDATIONS (34):

Improve international connectivity by eliminating the CCT and GPB tax on foreign airlines; implement 24/7 operations at international airports and seaports. Reform the CAAP. Develop/implement masterplans. Protect property rights in line with Tourism Act. Promotional resources should be directed to key tourist regions with infrastructure and direct international flights. Reduce business costs and enhance mobility for travel/tourism enterprises and tourists across the value chain (e.g. implement sustainable tourism taxation, streamline procedures, travel tax, customs and immigration, licensing, amend Sanitation Code). Pursue negotiations of public insurance portability for international medical travel and retirement. Promote transparency of medical travel packages. Develop and implement a national policy on wellness and medical travel. Facilitate seamless visits of medical travelers and health professionals (exchange programs with overseas hospitals) by issuing longer visas for patients/companions. Liberalize restrictions on foreigners in tourism and retirement zones to allow foreign ownership of land and retail facilities and practice of professions. Until the constitutional limit on foreign ownership of land can be reformed, JVs with reputable Philippine corporations as well as GRP agencies and LGUs should be encouraged. Encourage PRA co-investment in infrastructure (integrated retirement villages and nursing facilities) and DOT to support long-stay tourism and retirement.

Part 4. Other Important Reforms

The final section discusses challenges related to the general business environment and provides recommendations. Many of these issues have been advocated in recent years, by the JFC, Philippine business groups, PDF-TWGs, and the NCC and include all of the problems on lists of concerns in investor surveys. Implementation of recommendations in Part 4, along with Part 3, will help improve rankings in global competitiveness surveys in Part 2.

Key problems need to be addressed to generate jobs

The issues covered include (1) Business Costs, (2) Environment and Natural Disasters, (3) Foreign Equity and Professionals, (4) Governance, (5) Judicial, (6) Labor, (7) Legislation, (8) Local Government, (9) Macroeconomic Policy, (10) Security, and (11) Social Services (Poverty, Education, Health, and Population). A total of 177 recommendations are presented. Each has a suggested implementation period (immediate, medium-term, and long-term) and public and private sector action agencies.

Business Costs

Since 2006 the IFC has ranked economies on factors related to the ease of doing business. Of the ASEAN-6, the Philippines is the lowest ranked. This subsection includes: (1) Minimum wages. They are much higher in the Philippines than in competing regional economies; (2) Holidays. The Philippines had the highest number (21) among the ASEAN-6 economies in 2010; (3) Office rentals. Renting office space in Manila is a relative bargain; (4) Power. Costs which are twice or more than competing economies deter investment; (5) Telecommunications. Costs including broadband are higher than other ASEAN-6 economies, China, and India; (6) Heavy traffic, dilapidated ports, limited competition, and small ships make ground and inland marine transport inefficient and costly; domestic air for both passengers and cargo is inexpensive; (7) Red tape. The Philippines has a reputation for excessive and corrupt bureaucratic impositions. In the Global Competitiveness Report’s measure of the burden of government regulation, the Philippines ranked 113 of 133 countries. For burden of customs procedures, it ranked, lowest of ASEAN-6; (8) Expatriate living costs. The Philippines compares well. Manila is one of the least expensive major cities in Asia.

RECOMMENDATIONS (16):

Public and private sector leaders should create a national culture of competitiveness. Strengthen efforts to improve competitiveness by reducing business costs. Prepare an annual presidential report on competitiveness. Adjust minimum wages to be more in line with similar regional middle income economies, allow relief from minimum wages or piece work for distressed industries or find other measures that maintain jobs instead of losing them to other countries, including developing new industrial zones with infrastructure that offer lower wage rates. Reduce the burden of high holiday payroll expenses by reducing the number of non-working holidays. Reduce power costs for firms needing to maintain global competitiveness to survive. Introduce open access and power discounts. Modernize ground and marine transport to achieve competitive efficiencies. Accelerate efforts to reduce the red tape burden.

Environment and Natural Disasters

The Philippine environment has been under assault for decades from a fast-growing population and practices that degrade the country’s air, land, and water. Over half the country’s population lives in urban areas, where polluted air can be a silent killer, and solid waste management and sanitation are highly inadequate. There has been growing recognition of problems such bad habits have created and an increasing desire to introduce sound practices. With inadequate disposal capacity, Metro Manila faces a solid waste crisis. Despite passage of the Clean Air Act, vehicles spewing noxious fumes still ply Metro Manila’s streets due to weak enforcement. However, half of the 30,000+ taxis in Metro Manila have converted to LPG, and La Mesa watershed has been reforested. Extensive deforestation over a century contributed immensely to environmental degradation. Improved protection of watersheds, rivers, and estuaries is essential. Philippine urban areas have developed with little planning to mitigate the effects of natural disasters, despite their frequency. Storms and floods are the worst in terms of frequency and number of people affected. Earthquakes and volcanic eruptions are less frequent. As the world’s second largest archipelago, the country’s shores and estuaries are predicted inundated as seas rise from global warming.

RECOMMENDATIONS (14):

Implement policies of the Solid Waste Management, Clean Air, and Clean Water Acts. Deal effectively with solid waste. Reduce air and water pollution. Clean rivers. Improve access to water and sanitation. Establish clear rules and standards that would allow modern incineration technologies. Amend the Clean Air Act to allow non-polluting clean incineration. Benefit tourism, agriculture, and fisheries by reforestation, and rebuilding damaged coral reefs. Emphasize disaster prevention as well as disaster relief. Reduce flooding by improving drainage, zoning, and infrastructure. Make cities safer against earthquakes. Plan effectively for the impact of climate change/global warming.

Foreign Equity and Professionals

Reforms allowing more foreign equity participation in restricted sectors of the economy have not been a government priority. The Philippines significantly lags behind the ASEAN-6 and ranks in the bottom third of all countries surveyed by the WB (98th of 139) in having a regulatory regime favorable to foreign investment.The Philippine constitution is rather unique in containing foreign equity restrictions on certain business activities (Two presidential commissions have recommended their removal). The only significant change in the FINL since limited foreign investment in retail trade was allowed (in 2000) was the opening of gambling casinos to majority foreign equity (in 2010). The Philippines also is restrictive of foreign professionals practicing. The constitution states “the practice of all professions…shall be limited to Filipino citizens, save in cases prescribed by law.” There are 45 laws governing the practice of specific professions, and 40 contain “reciprocity” provisions allowing foreigners to practice. A Supreme Court rule limits legal practice to Philippine nationals, but only 5 of the 45 laws limit their professions to nationals. Few foreign professionals take exams or apply to the PRC, and few are approved. It should be in the Philippine interest to seek reduced restrictions on professionals in other countries, e.g. in WTO/GATS and AFAS, and to have more foreign professionals in the country who can bring new skills and connections to global networks, create more jobs for Filipinos, and support sunrise sectors like R&D, medical travel and retirement.

RECOMMENDATIONS (12):

A high-level commission should review current restrictions in the FINL and elsewhere, considering which will increase investment and create jobs, and propose remedial measures. Pending constitutional revision, apply creative but legal solutions, including the control test, to 60-40 ownership provisions, in order to increase investment and create jobs. The PRC should liberalize its procedures to accredit foreign professionals. The language regarding foreign nationals in the laws on professionals should be liberalized. The FINL should not include professionals. Philippine diplomacy should pursue global openness for Filipino professionals. Clarity is also needed to distinguish ownership of companies that provide professional services and the execution of medical services.

Governance

Filipinos and foreigners agree many problems of the country could be turned around with better governance. The reputation for political instability and widespread corruption persists. Of the ASEAN-6 it ranks lowest for Political Stability and Absence of Violence. During the decade (2001-2010), the TI rating of the Philippines fell to the bottom of a list of 14 Asian and South Asian countries. In the Global Competiveness surveys, corruption is cited as the top factor harming business. Smuggling is a major concern to business because it weakens the domestic market for manufacturers and for importers who pay duties and taxes. Domestic automotive production has been undercut by used car imports, negating the industry development plan. Huge sums that could build schools and provide better healthcare have been stolen through under-declaration of oil import volumes. The Philippines does not adequately protect IPR. While law is sound, sale of counterfeit goods remains widespread because of inadequate enforcement. The Ombudsman’s office lacks resources. Government procurement practices should be more transparent. GOCCs should be reformed and rationalized.

RECOMMENDATIONS (16):

Demonstrate firm, consistent political will to enforce laws against corruption forcefully in the public and private sectors, in revenue collection, and public expenditures. The government should join the Integrity Initiative of the private sector and submit government departments and agencies to the same tools, control mechanisms and integrity circles as the private sector. An impartial Ombudsman should be strengthened with trained staff. The private sector must do more to police its ranks and initiate compliance and integrity programs. Smuggling must be vigorously countered. The BOC with DOJ support should successfully prosecute smugglers. Further reform public sector procurement. Expand e-procurement, reform project selection process and bidding procedures, and intensify other efforts to reduce waste in public expenditures. Increase public sector transparency. Reduce the fiscal burden of GOCCs by fiscalizing, rationalizing, privatizing, and closing. Focus Congressional CDF on priority social infrastructure needs. Undertake civil service reforms to professionalize government. Reduce red tape. Strengthen corporate governance. Reduce IPR abuse. Legalize jueteng.

Judicial

Reforms in administration of justice should be intensified. Among challenges are clogged dockets, rulings that negatively impact on the business climate, the use of courts and sheriffs for legal harassment, and questionable TROs. Increased judicial salaries helped reduce the vacancy rate from 30 to 22% and, after peaking in 2000, the caseload for all courts declined from 1.5 to 1 million. The Alternative Dispute Resolution Act of 2004 encouraged more parties to arbitrate. The volume of new cases is down, and there is a 50% increase in their resolution. Caseload per judge has declined by half. With more judges handling fewer cases, the backlog should shrink and also the delay of justice. The number of graft and corruption cases filed before the Sandiganbayan has fallen since 2002, but the percentage of convictions increased. The Philippines rates poorly in the Global Competitiveness Report for efficiency of legal settlement, ranking far below other ASEAN-6 and 122 of 139 countries. The SC appears to have become more cautious about its decisions, harming the business climate. Its rulings supportive of the economy should be recognized. The SC should more often request amicus curiae advice in business-related cases. The SC docket is crowded with some 7,000 cases divided among 15 justices. The SC uses computers to track the status of cases. Greater selectivity would decrease the caseload and help the SC to meet the constitutional requirement to reach decisions within 24 months. The US SC only accepts some 150 of 10,000 petitions it receives each year.

RECOMMENDATIONS (12):

Continue judicial reforms to speed up justice in all courts by hiring more judges and increasing salaries. Continue to reduce the caseload of all courts by more encouragement of arbitrated settlements in civil cases. Improve BIR, BOC, and Ombudsman legal staff to prepare better cases with better prospects of successful prosecution and conviction. The Supreme Court should request amicus curiae expert advice when ruling on issues that may adversely impact on the investment climate. The Supreme Court could reduce its caseload by being more selective in accepting cases. Rules of the Court should be changed to recognize foreign arbitration decisions without reopening cases. Create a special court for Strategic Investment Issues. Oversee environmental courts so that application of Philippine environmental laws strongly supports responsible mining practices.

Labor

The Philippine economy is not creating enough high quality jobs for the growing population and to improve economic growth. Of a labor force of 39 million, 36 million are employed. Unemployment stood at 6.9% and underemployment at 17.9%. Over 9 million Filipinos would like to work more or would like to have some full or part time work. Over the last decade, an annual average of 846,000 persons entered the workforce. As the economy does not create enough jobs, some go abroad and some are unemployed. Without the overseas market, unemployment/underemployment rates could be 2 to 3 times higher. The country has the highest brain drain of the ASEAN-6. Much needs to be done to match educational and training curricula to available jobs. More young Filipinos need to acquire specialized fields related to the Seven Big Winner sectors. DOLE is undertaking Project Jobs Fit to identify the new, emerging employment sectors and the skills needed. The Philippine Labor Code is 36 years old and out of tune with regional developments. Disruptive labor action is infrequent. The economy has been unable to raise labor productivity. Of the ASEAN-6 only the Philippines has not increased labor productivity.

RECOMMENDATIONS (9):

Modernize the Labor Code. Rationalize holidays. Allow overseas service firm workers compensatory days off. Maintain the flexible working arrangements introduced in recent years. Focus on improving labor productivity. Create several million new direct jobs and many more indirect jobs. Attract manufacturers relocating from China. Reduce the unemployment and underemployment rates. Re-introduce the dual training system and support greater interaction between TESDA and the private sector. Allow self-regulation of companies with the support of chambers of commerce and industry associations. Continue to resolve differences without disruptive labor action. Reform the NLRC. Further narrow the skill-jobs mismatch by revising curricula and training.

Legislation

While the Philippines has many excellent laws, there is continual need to update old laws and legislate for new developments. Usually, the legislative process moves slowly, but sometimes bills move unexpectedly fast. 42 significant new business and economic reforms enacted in the 12th, 13th, and 14th Congresses are listed. Annex 1 lists more reforms over several decades. Speeding enactment of new laws and amending old ones should be a priority. With strong leadership, the 15th Congress can move twice as fast and pass many bills that improve the Philippine economy and competitiveness. 41 reforms for consideration in the 15th and 16th Congress are proposed. The list is organized into 8 categories according to the Seven Big Winners and General Business Environment. It has been endorsed by 5 PBGs and 7 JFC members, and recommended to the president and Congress. Annex 4 contains a list of 58 other potential reform laws. The private sector must be vigilant and oppose market-unfriendly proposals. Presidential vetoes are rare. The LEDAC used effectively during the Ramos Administration can be a good management tool for achieving the legislative agenda.

RECOMMENDATIONS (13):

The president should hold regular LEDAC meetings of executive and congressional leaders to prioritize the administration’s legislative agenda and monitor progress through the Congress. Prioritize bills that improve competitiveness, increase investment and revenue, and create jobs, in order to accelerate economic growth. Use executive orders and revision of IRRs to start reforms, following up with legislation as needed. Pass legislation more rapidly, especially for business and economic reforms. Prioritize key legislation close to final passage in the 14th Congress or that reached 2nd/3rd reading in either House or Senate. Avoid market-inimical legislation. Seek to make the FINL more positive. Simplify the present 45 laws regulating 46 professions to relax restrictions on foreign professionals and redefine reciprocity. Develop a comprehensive Philippine Legal Code and Code of Regulations.

Local Government

LGUs should be supportive of investors who bring jobs and revenue to their communities. Complaints are rare when LGU processes are transparent, efficient, fast, and honest. When they are not, investors complain, and the image of the Philippines is harmed. Surveys of domestic and foreign investors have scored “corruption” as the #1 business problem, with “inefficient government bureaucracy” #2. A survey records a decline in LGU bribery required to obtain licenses and permits from 55% in 2000 to 32% in 2009, still high but a hopeful indicator. A solution for bureaucratic corruption is reducing the number of signatures and using e-governance. Ratings of LGU competitiveness can encourage cities and provinces to improve themselves. When LGUs impose taxes or fees contrary to national policy or ban mining, they can harm the investment climate. This is a serious issue requiring attention.

RECOMMENDATIONS (16):

Intensify programs to improve LGU governance to make them more efficient and competitive, prioritizing LGUs in the fastest-growing regions. Expand e-governance services on LGU websites to enable routine transactions and to provide information on budgets and procurement. Increase efforts to correct issues identified in IFC Doing Business ratings and reduce solicitation of bribes. It is essential that the national government pay LGUs their tax share fairly and promptly. Intensify programs for LGU capacity building. LGUs should observe incentives and permits awarded by the national government to investors under national laws. The LGU Code, when amended, should include language to make the primacy of national laws clear. Declare certain investments, such as mining and power plants, as strategic to take them out of the influence of LGUs. LGUs should study which Seven Big Winner Sectors might be promoted in their localities to bring in more jobs and investments.

Macroeconomic Policy

Macroeconomic management of the economy has generally been sound since 1986 with the exception of periods of large deficits. Since the 2008-09 financial crisis, the biggest fiscal challenges are the unprecedented deficit and the weak tax effort. The tax effort peaked in 1997 at 17% and is currently 13%. In the WEF Global Competiveness Report, among the ASEAN-6 the Philippines places mid-way in the rankings for overall macroeconomic environment. Of the ASEAN-6 Philippine sovereign ratings and Vietnam’s are the lowest. Part 4 presents data on inflation, exchange rate, national government debt, debt service, budget deficits, gross international reserves, tax effort and rates, savings, often in comparison with the ASEAN-6 and others. The country rates poorly within the ASEAN-6 for heavy taxation. In the World Economic Forum’s 2010 rankings for the category burden of government regulation, the Philippines placed 126 of 139 countries, the lowest among the ASEAN-6 and near the bottom of the total ranked. Investors seek a stable and predictable policy environment with low risk, which has too often not been true in the Philippines. Many new FTAs present great opportunities to develop new export markets. Negotiations including the US are ongoing to expand the 4-country TPP to 9 or 10 members. The Philippine economy would be hurt if not included. The EU and the Philippines have agreed to negotiate a new, bilateral PCA.

RECOMMENDATIONS (29):

Constantly improve financial sector management. Reduce the record-high public sector deficit, maintain low inflation, stable exchange rates, reduce debt service burden, increase capital spending, privatize more state assets, convey an austerity message, reduce congressional pork barrel. Maximize tax collection to raise the tax effort to 15%. Jail smugglers and big tax evaders, using RATE and RATS. Use transparency and e-governance, National Single Window, E2M. Simplify taxes and fees. Undertake comprehensive tax reform to reduce CIT and individual income tax, while raising VAT, ACT, and fuel excise taxes. Reduce or eliminate small taxes and fees that increase business costs. Increase the low savings rate and strengthen capital markets. Increase independence of regulatory agencies and reduce the burden of government regulation on the private sector. Maintain policy predictability and stability. Optimize new trading opportunities.

Security

Security issues are a serious investment climate concern, especially in some rural areas, for the mining and tourism sectors, and in parts of Mindanao. This section discusses: external security, internal security (insurgency, terrorism, and warlordism), military extra-constitutional actions, crime, defense and police capabilities, economic development of Mindanao/Sulu, and foreign government travel warnings. The World Bank measure Political stability and the absence of violence and terrorism shows the Philippines is lowest-ranked among ASEAN-6; however, Thailand and Indonesia also ranked low. In Global Competitiveness the Philippines ranked lowest of ASEAN-6 for Business costs of terrorism and Business costs of crime and violence. At 1% of GDP, military spending is the lowest of the ASEAN-6. The homicide rate is the highest of 10 Asian countries. Solutions for Mindanao/Sulu include (1) better governance and economic growth that undermines the appeal of local combatants, (2) an implementable political settlement with the MILF, and (3) military/police action against the ASG. Mindanao infrastructure, especially the unreliable supply of power, inadequate ground transport, and high domestic shipping costs, needs urgent attention.

RECOMMENDATIONS (15):

Improve political stability and reduce violence, terrorism, and human right abuses. Use different strategies to deal with the MILF, NPA, and ASG. Negotiate with the MILF and NPA and use force to isolate/eliminate ASG. Reduce violence in Mindanao/Sulu and increase economic development in that island’s poorest provinces. Develop then implement Mindanao 2020 Peace and Development Plan, emphasizing better infrastructure and lower shipping costs. Reduce/eliminate warlordism. Expand CCT, Kalahli-CIDSS, and other programs that reduce government neglect of population in remote areas. Modernize armed forces and police; increase their numbers. Avoid extra-constitutional actions by military personnel. Reduce crime, especially murders and kidnappings. Encourage balance in foreign government travel warnings.

Social Services: Poverty

As a percent of population, poverty has decreased from 41% in 1985 to 28% in 2006. In terms of actual population, however, it increased from 22 million in 1985 to 24 million in 2006. Among the ASEAN-6 the Philippines has the most persistent incidence of poverty (< US$ 1.25 a day). The poor are often hungry, their diet inadequate, and their children malnourished. The September 2010 SWS poll counted 16% of households – equal to 3 million families – claiming having had nothing to eat at least once in 3 months. The Philippines has the highest percentage of slum population as a percent of urban population among 6 Asian countries. The poor do not have PhilHealth insurance and most die without seeing a doctor. CCTs as a means of reducing future poverty are being introduced.

RECOMMENDATIONS (4):

Steadily reduce the number of poor and poor as percentage of population. Reduce the incidence of hunger. Expand insurance coverage to include more poor. Expand the CCT program to include all 6.9 million poor Filipino families.

Social Services: Education

Education determines the quality of tomorrow’s workforce; appropriate skills are essential for a middle-income economy trying to increase its knowledge-based sectors. Philippine education needs both policy reform and greatly increased resources. All educational levels have deteriorated over several decades, faced with a young population that has outstripped resources. In the Global Competitiveness Report the Philippines ranks 69th of 139 countries for quality of the education system. While slightly behind Thailand and Vietnam, the country is declining and will stay lowest-rated in the ASEAN-6 without educational reform. Of the ASEAN-6 the Philippines spends the least per student. Malaysia, Thailand, and Vietnam spend more than twice as much. Graduate perform poorly. The 10-year basic education is the shortest in the Asian region. Competitors follow a 12-year basic education system, then four years of college. High school/college graduates are inadequately prepared for employment. Drop out rates are high; only 12% finish college. Classrooms in basic education are over-crowded. Pupil-teacher ratio is higher than most Asian countries. The WEF rating for quality of math and science education ranks the Philippines as 112 of 139 countries. Competitors, such as China are moving much faster. For example, over the last decade China has nearly tripled the share of GDP devoted to education (In the Philippines, the GDP share declined). Double the number of colleges and quintuple the number of college students. The Philippines cannot afford further deterioration of English in public schools and lose its main competitive advantage, its large English-speaking workforce.

RECOMMENDATIONS (12):

Increase public education budget over several years to at least PhP 400 billion (3.5-4% of GDP) for better classrooms, more and better teacher quality, and reduced teacher/student ratio. Double average spending per student to ASEAN-6 average. Adopt K+12 model to extend basic education by two years and add a pre-elementary year. Constantly improve teacher quality and curriculum to produce graduates with skills required for higher quality jobs. Apply competency-based standards, more in-service training, maintain teacher welfare and morale. Increase study of math and science, technical/vocational skills training. Encourage college/post-graduate study in fields needed for specialized positions, including foreign languages. Intensify investment in technology for high school education to connect all 6,786 schools to Internet. Equip high school teachers with notebook computers and students with e-readers. Establish computerized English language centers in high schools. Strengthen higher education by providing more resources for worldclass centers of excellence. Expand scholarships and loans for higher education. Encourage more accredited foreign schools and foreign teachers. Undertake a vigorous public campaign to emphasize English language competency. Strengthen the Dual Education/Dual Technical System. Expand the internship period to prepare students better for employment.

Social Services: Health and Population.

Good health is a concern of the business community. Healthy employees are more productive, have lower absenteeism, and cost less for health care premiums. Healthier children are better able to benefit from education and contribute to the economy. Good health supports increased labor productivity, which supports higher wages. The national government spent about 1.25% of GDP on public health programs in 2007, half as much as Thailand and Vietnam. Per capita spending is the lowest among the ASEAN-6. Better health care services are provided by private health care services for upper income groups. The goal of RA 7875 (1995) that created PhilHealth to provide social health insurance coverage to all Filipinos in 15 years has not been achieved. The total number of hospitals has barely changed in 20 years. The poorest segment of Philippine society has the least access to health care services and has serious health problems. The Aquino administration plans to introduce Universal Health Care.

Population determines the size of the workforce. Population policy supports the freedom of parents to choose family size. The debate is intense about whether the Philippines is over-populated and how many people the land and government can support Reproductive health policy should be everyone’s concern under the goal of responsible parenthood. It effects whether parents are well-informed in exercising their right to choose among alternative methods of determining family size and their ability to raise children who will become productive citizens. Official estimates show the Philippine population growth rate has slowed from 3.08% between 1960 and 1970 to 2.04% since 2000, a 34% decline, possibly as an effect of rising urbanization, more aggressive campaigns of health advocates, and increased access to information and methods of family planning. However, unless the growth rate continues to slow, the number of Filipinos could double again to 200 million.

RECOMMENDATIONS (9):

Double national spending on healthcare to 2.5-3% of GDP. Direct spending to the poorest Filipinos. Government hospitals should be modernized, rationalized, expanded, and many thousands of additional village health centers built. Provide better equipment and staff. Expand PhilHealth eventually to become UHC. Include poorest Filipinos at no cost, financed by premiums on higher-income groups. Cease misguided healthcare legislation that does not achieve policy goals. Use PPP to encourage private capital to invest in healthcare-related services. Government should target an achievable population growth rate, set parallel targets to increase contraception prevalence rate and to lower fertility rate, and design and implement a reproductive health program to achieve targets. Congress should pass a consensus version of reproductive health legislation. The private sector should support reproductive health policy legislation and assist employees to have smaller families. Government should reward poor families who have fewer children. PhilHealth should introduce a family planning requirement for hospital accreditation.

Footnote

- Defined by the World Bank as the threshold for high-income status. [Top]